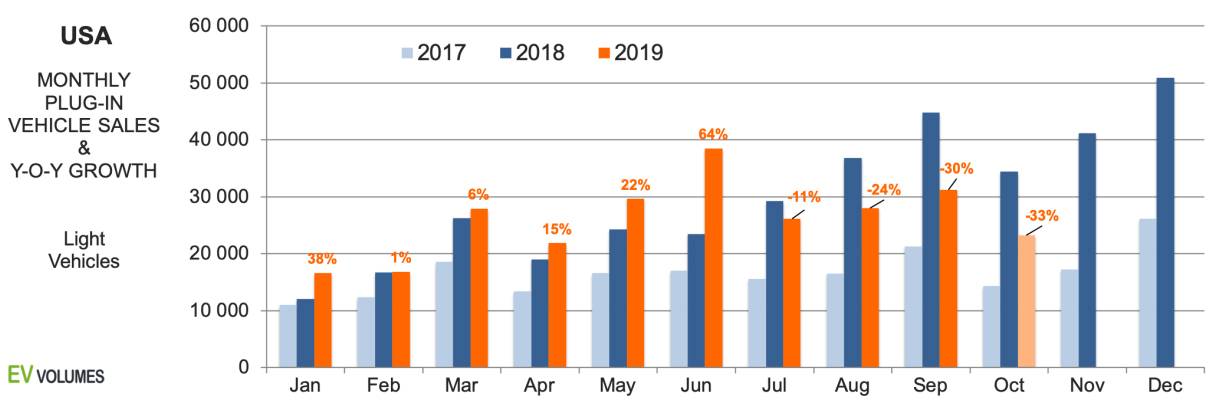

236 700 plug-in vehicle were delivered in the first 3 quarters of 2019, an increase of just 2 % compared to Q1-Q3 of 2018. Including the October result, 23 200 units, which was 33 % lower than in Oct 2018, the sector is now in reverse for the year. The negative trend is much likely to stay for the remainder of 2019 and the first half of 2020. The bleak picture is caused by a variety of factors. First, the numbers compare to the period H2-2018, when Tesla delivered on all the pend up demand for the Model-3. Sales were in USA and Canada only; exports to other markets did not start before Q1 of 2019.

The second observation is that many OEM sold fewer plug-ins in 2019 that they did last year. Whereas the European importers held the line, plug-in sales by the Big-3 were down 28 %, so far and Japanese brands lost 22 %. American and Japanese brands stand for 44 % rsp 38 % of US light vehicle sales, but have introduced only one new plug-ins this year, the Subaru Crosstrack PHEV. Tesla sales are 9 % up year-to-date and stand for 55 % of the plug-in volume in the US. Counting BEVs only, the Tesla share is 76 %.

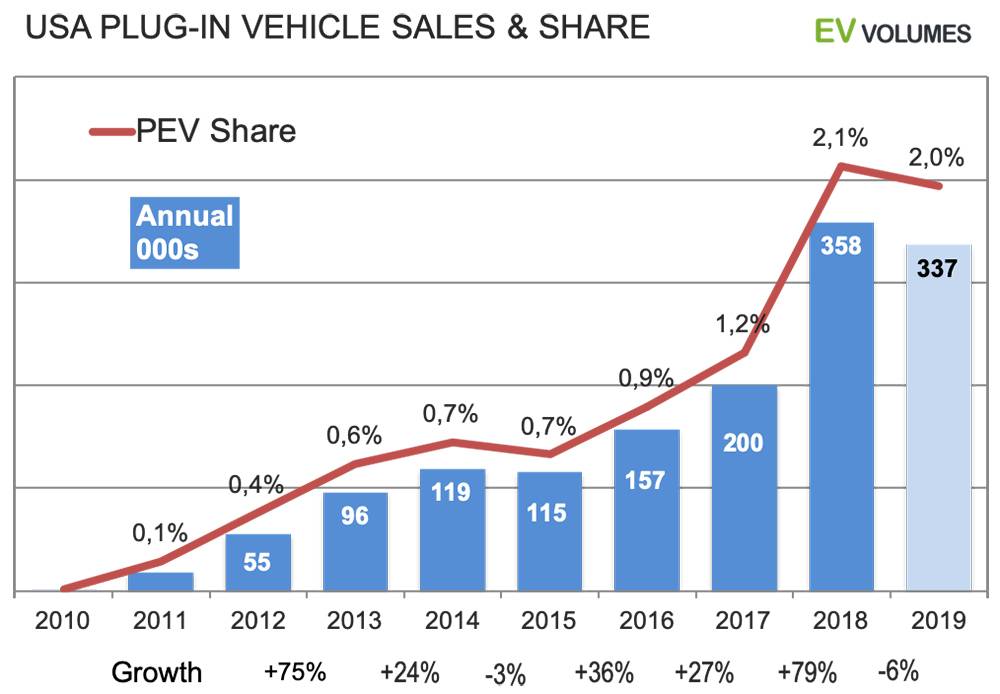

Our expectation for the year is a total of 337 ooo units of BEV+PHEV sales, 74 % of them pure electric. The volume decrease compared to 2018 is 6 %. For 2020, manufacturers have announced over 20 new BEV and PHEV entries, most of them PHEVs from European brands. The new big-sellers will be from Tesla and Ford, though. The Model-Y and Mach-E enter the very popular compact/mid-size cross-over segment, being very close in size, price and specification. The given contest in next years’s EV market and with plenty of attention and demand.

More Losses than Gains

The chart compares the quarterly USA plug-in sales of 2019 compared to last year. Q4 of 2019 are our estimates. Tesla sales are down for the 2nd half of 2019 as they compare to the 2018 period when all Model-3 deliveries covered the demand and back-log in North America. Tesla volumes for the year will still be approximately 9 % higher than in 2018. The YTD sales of OEM other than Tesla with last year’s reveal a bleaker picture: a combined decrease of 16 %.

Hyundai-Kia (new Kona EV), Volkswagen (e-Golf, new Audi e-tron quattro), Daimler (Merc. GLC) and Jaguar i-Pace gained, all others posted heavy losses. Nissan Leaf sales remain weak, the new 62 kWh version is overpriced and still without state-of-the-art battery cooling. GM dropped the Volt and reached the 200 000 unit limit in Q2, receiving only half of the $7500 federal EV tax credit in Q4. Ford dropped the slow selling Focus EV and C-Max PHEV and is left with the ageing Fusion PHEV. Toyota offers nothing but the 3 year old Prius PHEV, the Honda Clarity PHEV is in pre-mature decline. BMW still lacks the replacements for 330e and X5 PHEVs in the US.

Boom and Downturn

The USA plug-in sales history had a temporary decline before and, like for 2019, it was supply related: Toyota phased out the 1st generation Prius PHEV without having the successor ready and GM lost volume during the change-over to the 2nd generation Volt.

2018 had exceptional growth and nearly all of it was created by just one new entry, the Tesla Model-3. Achieving the 2017-18 growth for another year is hardly possible. Tesla delivered 140 000 Model-3 in USA last year and exports were to Canada only. This year, Model-3 deliveries in the US will increase by another 15-20 000 units, but they do not compensate for the volume losses of other, ageing and discontinued entries.

The current impression is lack of choice and lack of news, especially from the Big-3 and Japanese OEM, which stand for 82 % of total light vehicle sale this year. The situation will change a lot in 2020, with a broad based increase from new models with high sales potential.

Post time: Jan-20-2021